Hospital finances have been in disarray since the pandemic upended normal business. Rising costs, staffing shortages, and delays for elective surgeries changed the equation that most healthcare organizations are familiar with. Things are now, unevenly, starting to return to normal as inflation is calmed and revenue-generating procedures increase, although staffing and burnout remain a concern industry-wide.

Consulting firm Kaufman Hall tracks hospital finance trends using data from over 1,300 hospitals. Their most recent monthly report examined data from December of last year and found that hospital margins were up over 15 percent compared to December ’22. While the report reiterates that expenses need to come down, a big takeaway was that hospitals are marching toward pre-pandemic finance levels.

These are averages and trends though, not all healthcare systems are enjoying a move back to normalcy.

Despite the improvement in aggregated finances, 2023 had the highest level of healthcare bankruptcies in the past five years, climbing to 79 from 46 in 2022. 12 of these bankruptcies showed liabilities of more than half a billion dollars.

12 of the bankruptcies were also specifically attributed to hospitals, which had filings at the highest level since 2019. These 12 tell part of the story, along with seven rural hospital closures in 2023 and 117 acute care hospitals that closed between 2018 and 2022 instead of declaring bankruptcy.

Some of this is the culmination of multiple difficult financial years during the pandemic without enough runway to take advantage of the ongoing normalization. The difficult top- and bottom-line pressures have been further compounded by high interest rates, restricting the ability to get a cash flow lifeline until conditions improve.

While there were some large bankruptcies, bigger hospitals can generally withstand temporary upheaval better than smaller ones, so groups like rural hospitals don’t have as much leeway in waiting on environmental factors. In addition to the seven closures last year, healthcare advisory company Chartis published a study on Tuesday indicating that half of all rural hospitals are operating at a financial loss.

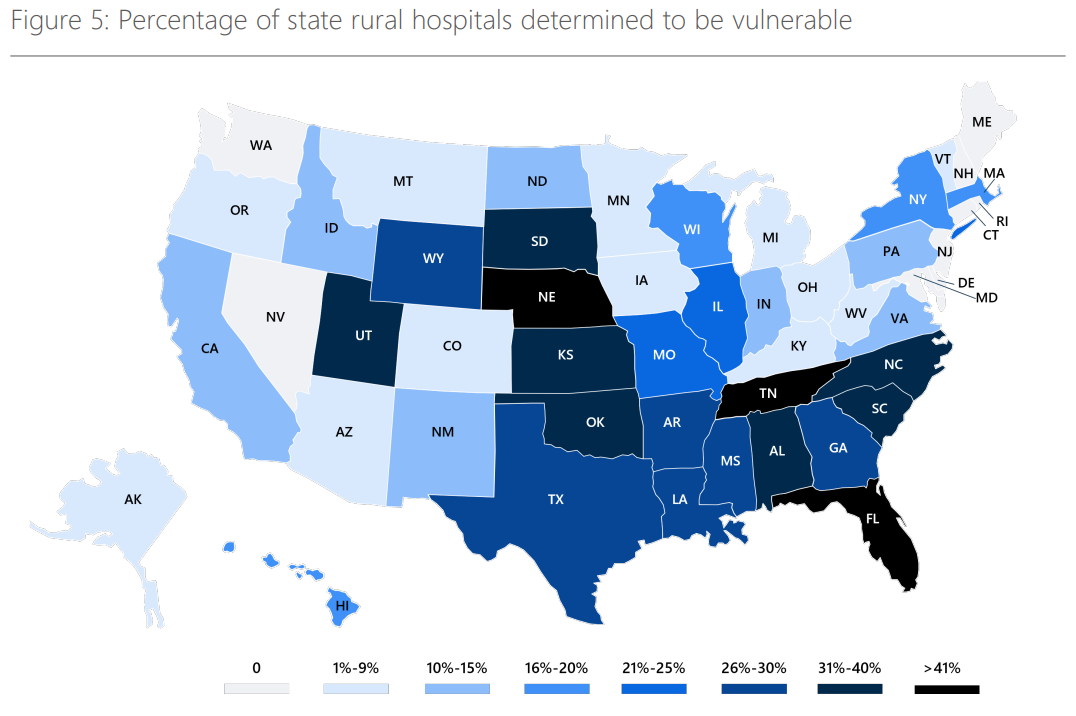

Hundreds of rural hospitals have discontinued obstetrics and chemotherapy services over the past decade and have increasing reliance on Medicare Advantage patients. More than 400 rural hospitals are considered “vulnerable to closure.” Chartis began using its rural hospital vulnerability model in 2020, identifying 453 vulnerable hospitals. Since then, 30 hospitals from the list have closed and currently 418 remain. This means that one out of every five rural hospitals are facing closure, with individual states facing the prospect of losing more than 40% of their rural hospitals.

Source: Chartis

For some of the challenges hospitals are facing, like interest rates or a pause in elective procedures, there’s no other option than to wait things out. What healthcare organizations can focus on is optimizing their current processes, automating where possible, and deploying their staff at the best and highest possible use.

Extract’s suite of software saves hospitals money by automating their repetitive document management tasks. Our software automates the classification, indexing, abstraction, and routing of non-interfaced documents. We multiply the productivity of your existing staff, allowing organizations to improve data accuracy and completeness and increase document processing capacity with fewer resources.

If this sounds interesting, please give us a call; we’d be happy to show you how automation can save money in your specific workflow.

About the Author: Chris Mack

Chris is a Marketing Manager at Extract with experience in product development, data analysis, and both traditional and digital marketing. Chris received his bachelor’s degree in English from Bucknell University and has an MBA from the University of Notre Dame. A passionate marketer, Chris strives to make complex ideas more accessible to those around him in a compelling way.